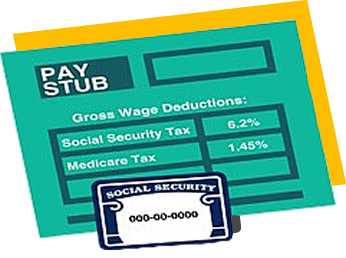

What is FICA? FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck.

FICA TAX Savings Program

If you are an employer that has 10+ W2 employees on payroll, you can save $700 – $800 per employee on an annual basis… and to top it off, your employees will receive a 4% – 6% net increase in take-home pay + medical benefits.

All this is possible through Encompassing Health.

The affordable care act (a bill passed by Congress) states that if an employee engages in medical care benefits offered through a section 125 program, they are eligible to receive a $1,000 claim payment per month.

This claim payment ultimately lowers the FICA spending for both the employer and their employees.

Think about it like this… Encompassing Health is a coupon for FICA taxes!

Encompassing Health is the BEST section 125 program on the market.

- 100% compliant (based on IRS guidelines)

- Approved in all 50 states by the Department of Insurance.

- Highest net savings to employers ($700-$800 per employee annually)

- Highest net increase to employees (4%-6% increase in pay)

- Automated "Newsletter System" for employee engagement.

Encompassing Health is the only section 125 program that has been approved by the department of insurance in all 50 states, and that has an A+ rated carrier (insurance company) backing it.

Now the choice is yours. You can pay more or pay less when it comes to your FICA taxes.

Partial Suspension – Suspended by Government Order

Partial Suspension

- To meet the requirement of a partial suspension of operations for the purpose of claiming the ERC, a business must have experienced a nominal impact to their operations as a result of government order restrictions.

Governmental Orders

- It’s important to consider “orders from an appropriate governmental authority” as defined by the IRS.

- These orders include those issued by the federal government, state governments, or local governments that limit commerce, travel, or group meetings (for commercial, social, religious, or other purposes) due to COVID-19.

Defining Nominal Impact:

Two Considerations

- More than a Nominal Portion of business operations are suspended or modified by a governmental order.

- According to the IRS guidance suspended, restricted or modified portions of a business’s operations is considered to be more than nominal if:

1- Gross receipts from that portion account for 10% or more of a business’s total gross receipts, OR

2- Employee hours worked related to that portion account for 10% or more of the total hours worked. - Note: Source IRS Notice 21-20 – Ref: IRS

FAQ#11 & Ref: IRS FAQ#18

Note: An employer’s independent decision to suspend part or all of its operations does not meet these criteria.

The Statutory History of ERC

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck.

- PPP first draw made available

- Taxpayer must choose between

- PPP or ERC, cannot claim both

- ERC made available from

March – December 2020

——-♦3/27/2020———————–

- PPP second draw made available

- PPP recipients can now claim ERC

- ERC extended through June 30, 2021

——-♦11/27/2020————————

- ERC extended through December 2021

- Eligible for Q1-Q4 2021

——-♦3/11/2021————————-

- ERC Q4 2021 eliminated

- ERC ends 9/30/2021

——-♦11/15/2021—————

What is the FICA?

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck.

Potential Refund Amounts

Up to $26,000 per employee

[5k per employee in 2020

7k per employee per eligible

quarter in 2021]

Multiple Years Available

Available for 2020 & 2021

Government Funds Available

Funding based on eligible

wages

Ways to Qualify

Qualify with decline in

revenue or full/partial

shutdown of business

operations due to

governmental orders

About Us

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck.

750 Third Avenue, #122217, Chula Vista CA 91910

info@ng3.com elviahernandez@ng3.com

+1 619-204-8220

Mon – Sun de 9am a 9pm PST